What is a Credit Score?

A credit score is a numerical representation of an individual’s creditworthiness, compiled from various financial behaviors and activities. This score typically ranges from 300 to 850, with higher scores indicating lower risk to lenders. Understanding what constitutes a credit score is crucial for anyone seeking to maintain or improve their financial health. The score is primarily based on several core components: payment history, credit utilization, length of credit history, types of credit, and new credit inquiries.

Payment history is the most significant factor, accounting for approximately 35% of the credit score. It reflects an individual’s ability to meet financial obligations on time. Late payments, defaults, or bankruptcies can drastically lower a credit score and hinder one’s ability to secure loans or receive favorable interest rates. Alongside payment history, credit utilization—representing the amount of available credit used—plays a pivotal role, constituting about 30% of the score. Ideally, individuals should strive to keep their credit utilization ratio below 30% to maintain a healthy credit profile.

Length of credit history also influences the score, representing about 15% of the total. This aspect highlights the importance of maintaining older accounts, as a longer credit history typically benefits one’s score. Additionally, the diversity of credit accounts, which includes credit cards, mortgages, and retail accounts, contributes to approximately 10% of a credit score. A variety of credit types can indicate a well-managed financial life. Lastly, new credit inquiries, which make up 10% of the score, reflect how often a consumer is seeking new credit. While a few inquiries may have a negligible impact, excessive inquiries in a short time frame could signal risk to lenders.

Ultimately, credit scores play a vital role in financial decision-making, affecting everything from loan approvals to the interest rates offered by credit providers. Understanding and regularly monitoring one’s credit score can lead to informed financial choices and improved economic opportunities.

Breakdown of Credit Score Ranges

Credit scores play a vital role in determining an individual’s creditworthiness and subsequently influence their ability to secure loans, credit cards, and other financial products. Credit scores generally range from 300 to 850, with higher scores indicating better creditworthiness. These scores are categorized into different ranges that express varying levels of credit quality.

The first range is considered poor, typically falling between 300 and 579. Individuals in this category are generally viewed as high-risk borrowers, making it challenging to obtain loans or credit. When they do qualify, the interest rates tend to be significantly higher due to their increased likelihood of default.

This leads us to the fair range, which spans from 580 to 669. While individuals within this range may have some access to credit, it might come with higher interest rates and less favorable terms. Borrowers in this range may find it more difficult to secure loans for larger purchases, such as homes or cars.

Moving up, the good range covers scores from 670 to 739. Borrowers in this category are viewed as acceptable risks and generally qualify for a wider range of credit products, often at competitive interest rates. Lenders are more willing to offer loans to these individuals, recognizing their potential for reliability.

The very good range, typically between 740 and 799, signifies a strong credit profile. Individuals in this range often enjoy lower interest rates and more favorable loan terms. They are seen as low-risk borrowers, and their options for credit products are considerably broader.

Lastly, the excellent range is reserved for scores from 800 to 850. Individuals in this category represent the pinnacle of creditworthiness, qualifying for the best possible rates and terms available in the market. Lenders are eager to extend credit to those within this spectrum, reflecting their financial responsibility.

Impact of Credit Scores on Financial Opportunities

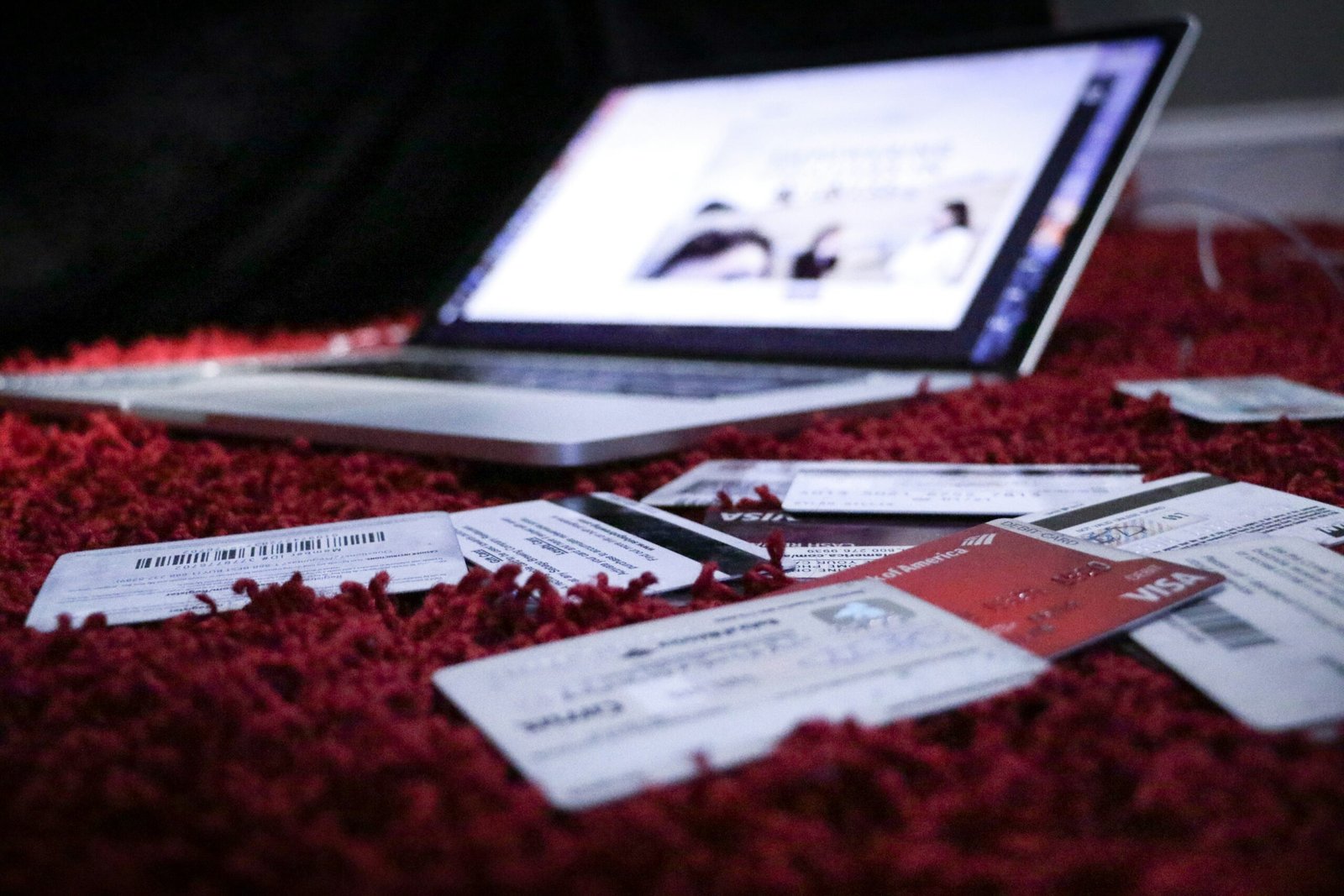

Credit scores play a pivotal role in shaping a person’s financial opportunities. They serve as a numerical representation of an individual’s creditworthiness, derived from credit history, outstanding debts, payment history, and other factors. Institutions utilize these scores to assess the risk associated with lending and to determine favorable financial terms. Consequently, varying credit scores can lead to drastically different outcomes when applying for loans, credit cards, or even housing rentals.

For instance, a person with a credit score in the excellent range (typically between 750-850) is often rewarded with lower interest rates on loans. According to studies by FICO, individuals with the highest credit scores may receive an average interest rate of 3.5% compared to 6.5% for those with lower scores, resulting in significant savings over time. This discrepancy illustrates the tangible financial benefits that may accompany a higher credit rating.

In terms of credit card availability, consumers with better credit scores generally qualify for premium credit cards that come with additional benefits, including rewards programs, cashback offers, and travel perks. On the contrary, those with lower scores may only have access to secured credit cards, which typically require an upfront cash deposit and offer limited credit limits.

Furthermore, credit scores can influence rental applications, with landlords often conducting credit checks to evaluate prospective tenants. A higher score can enhance one’s chances of securing a favorable rental agreement, potentially saving them from larger deposits or stricter lease terms. Similarly, insurance companies leverage credit scores to determine premiums, with individuals exhibiting lower credit scores facing higher rates due to perceived risk.

Overall, the impact of credit scores on various financial opportunities illustrates the importance of maintaining a healthy credit profile. Understanding how these scores affect everyday decisions can empower individuals to take proactive steps to improve their financial standing, ultimately leading to better opportunities in their personal and professional lives.

Improving Your Credit Score

Enhancing your credit score is a critical aspect of achieving financial stability and long-term success. Several strategies can contribute to an improved credit profile, ensuring you are equipped to manage your finances wisely. One fundamental practice is to ensure timely payments on all bills, including credit cards, loans, and utility services. Consistently paying your bills on or before the due date helps establish a positive payment history, which significantly influences your credit score.

Another effective tactic is to reduce your credit card balances. High credit utilization—defined as the ratio of your credit card balances to their limits—can negatively impact your score. Aim to keep your utilization below 30%, and ideally lower. This can be accomplished through increased payments, avoiding unnecessary charges, and periodically reassessing your spending habits.

Managing debt wisely also plays a vital role in credit score improvement. Consider consolidating your debts or negotiating repayment plans, particularly if you’re facing financial challenges. This helps streamline your payments and may reduce interest rates, easing the burden and allowing for quicker repayment. In addition, think about using automated payment options to avoid missed deadlines.

Regularly checking your credit reports for errors is equally important. Errors can occur, and they may detrimentally affect your score, hindering financial opportunities. You are entitled to free credit reports from each of the three major credit bureaus annually; utilize these resources to scrutinize your reports for inaccuracies and initiate disputes as necessary.

For those seeking additional assistance, numerous organizations and online resources offer guidance on credit score enhancement strategies. Consulting financial advisors or credit counseling services can also provide personalized support. By adopting these actionable steps, individuals can successfully improve their credit scores, paving the way for better financial outcomes.